Impact of the COVID-19 Outbreak on the U.S. Hotel Industry

4 Key Takeaways

On Monday, Smith Travel Research (STR) conducted a webinar sharing an initial look at the impact of the COVID-19 outbreak on the U.S. hotel industry. You can view STR coverage of the outbreak online, and we’ve shared key takeaways from the webinar below.

1. A Drop in Occupancy is Expected

Source: STR 2020 © Costar Realty Information, Inc.

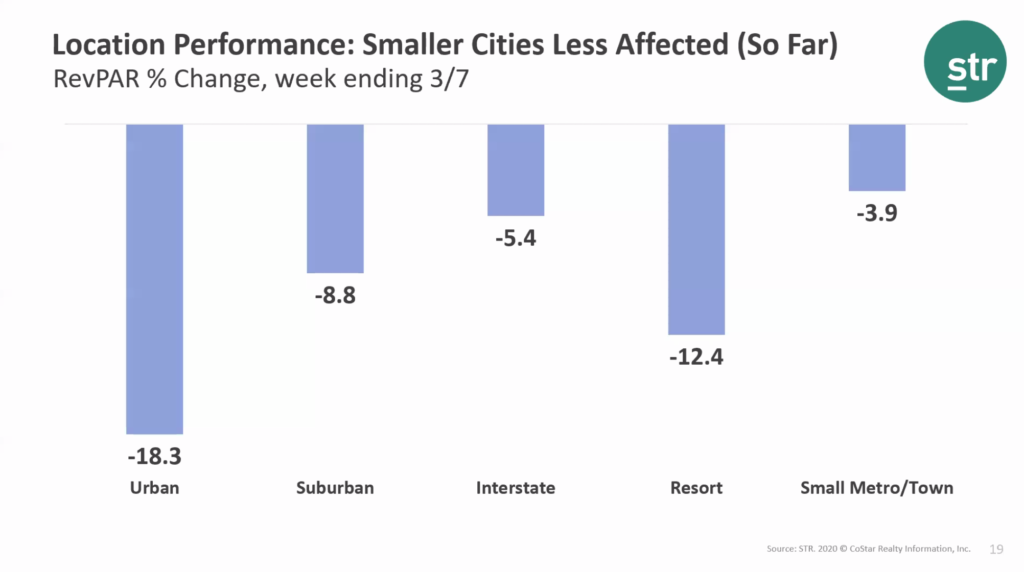

As mandatory and voluntary quarantines become more common, travelers are initiating fewer trips. The impact of large groups and event cancellations will increase the speed of occupancy drops. But how bad are things going to get? As of now, it’s difficult to forecast the specific effects to expect in North America. Since China was the first country impacted by the outbreak, it makes sense to look at their trends first. They felt the impact incredibly fast. In China, occupancy dropped by 89% in just 2 weeks. We should note that travel was more restricted in China than it’s been in the U.S. so far. In America, we have already started to see the virus impact RevPar. As of the week ending March 7, the U.S. has experienced a RevPar decrease of 11.7%. It’s important to make proper preparations now, to ensure your hotel is in the best position possible to combat these slower times.

2. We Can Expect the Industry to Bounce Back

Source: STR 2020 © Costar Realty Information, Inc.

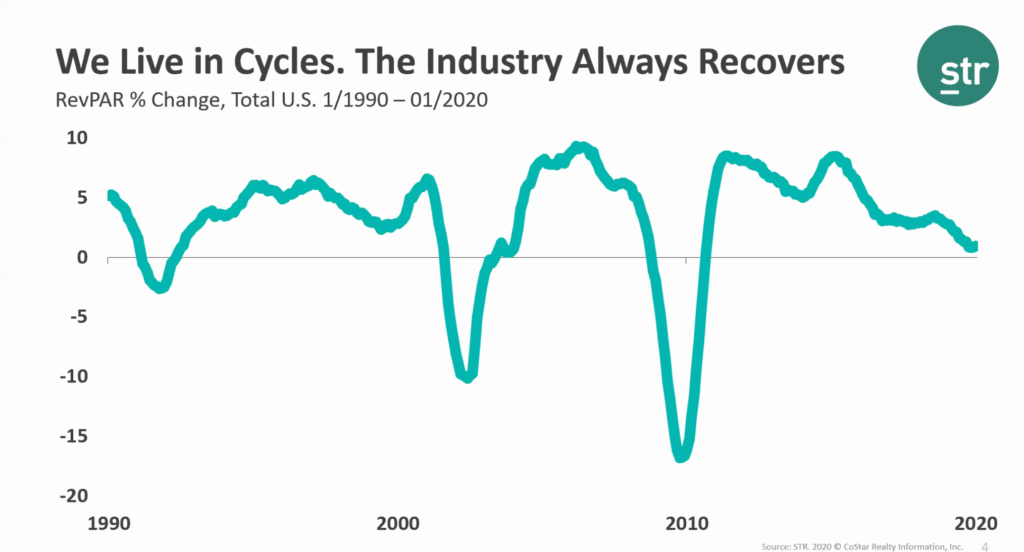

STR is analyzing previous industry-wide drops in RevPAR to help forecast what to expect in 2020. Whether it was the impact of 9/11 in 2001 or the great recession in 2008 on travel trends, our industry is proven to be incredibly resilient. According to STR, China’s occupancy is already starting to bounce back from its lowest point. We do not know how long it will take, but we are confident that it will get better. STR experts anticipate that however long it takes for RevPAR to hit its lowest, it will take twice as long to rebound.

3. Group Travel Might Take a Little Longer

Source: STR 2020 © Costar Realty Information, Inc.

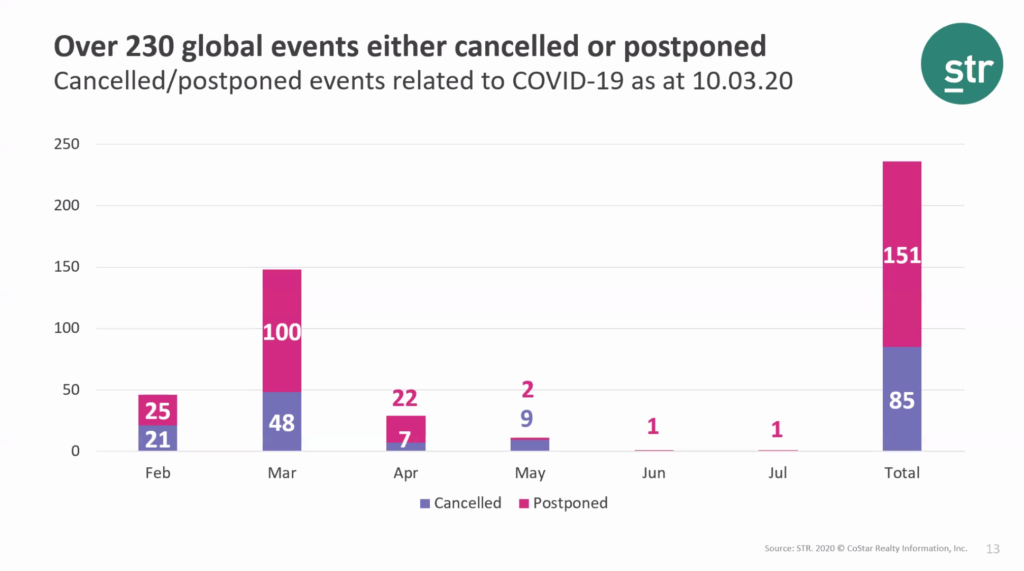

According to STR, as of March 10, more than 230 major global events have either been postponed or canceled. These cancellations are a major contributing factor to drops in occupancy and revenue for the hotel industry. Companies will also limit or eliminate employee business travel during this time. As a result of these two factors, group travel will continue to decline. For hoteliers, it’s difficult to lose these major deals. While some effort can be made to postpone corporate events for later months, businesses may have low confidence in rescheduling. As the market starts to rebuild and people begin traveling again, place your primary effort in booking individuals rather than groups. Prepare now to adapt your marketing strategies to target more transient travelers to offset the potential loss in group travel.

4. Industry Optimism Remains High

Source: STR 2020 © Costar Realty Information, Inc.

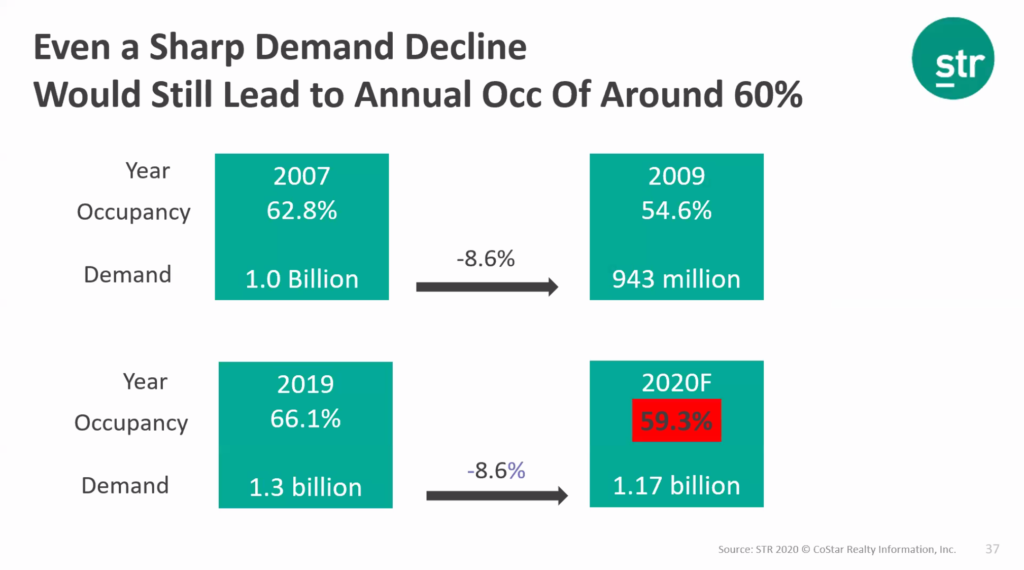

Despite the news, optimism remains high for the travel industry. Prior to the COVID-19 outbreak, occupancy and demand in the industry were at an all-time high. STR, concluded that if demand were to drop at the same rate as it did after the 2008 great recession, the industry would still experience almost 60% occupancy for 2020. We also have reason to suspect that travelers will be eager to make plans once quarantines are lifted. STR also conducted a survey of Chinese international travelers and 50% of those surveyed answered that they plan to take more international leisure trips than they did in the previous year. Don’t give in to the impulse to panic, but instead be prepared and stay vigilant.

For more information, including weekly webinars and the impacts of COVID-19 on the industry, visit STR.

The COVID-19 crisis is already separating out winners and losers by those that had strong digital presences and strategies to drive business. This is keenly felt in restaurants where online orders, which had represented a fraction of order volume, have become the primary revenue driver as business shifts entirely off premises.