Important COVID-19 Takeaways from STR’s Latest Trends for Hotels

As the coronavirus continues to sweep across the States, leaving economic distress in its wake, hoteliers everywhere are feeling the impact. Every week, STR provides updates on the state of the industry and its projected path for the future, and we listened in on another webinar that summed up the week of March 28.

These statistics may look scary at first glance, but they are not without silver linings. In digesting this data, we’ve put together more key takeaways for you to keep in mind as we continue to weather this storm together.

“It’s not the end, but it may be the end of the beginning.”

The above quote from Winston Churchill exemplified the overarching theme of last week’s webinar: we are not out of the woods yet, but as numbers reached record-breaking drops in occupancy, STR’s reports show that the biggest drop off in occupancy may be over. What that means we can hopefully anticipate consistency in the change of these rates week over week.

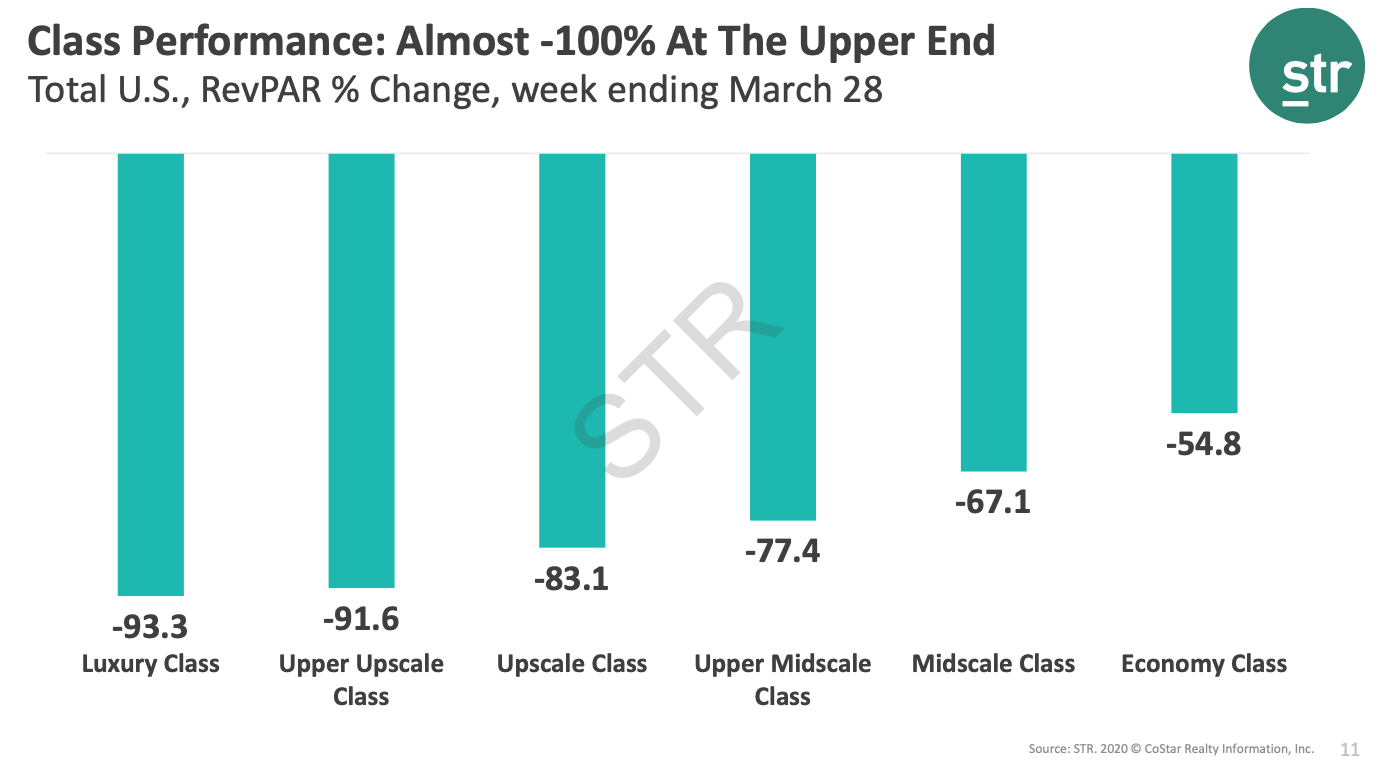

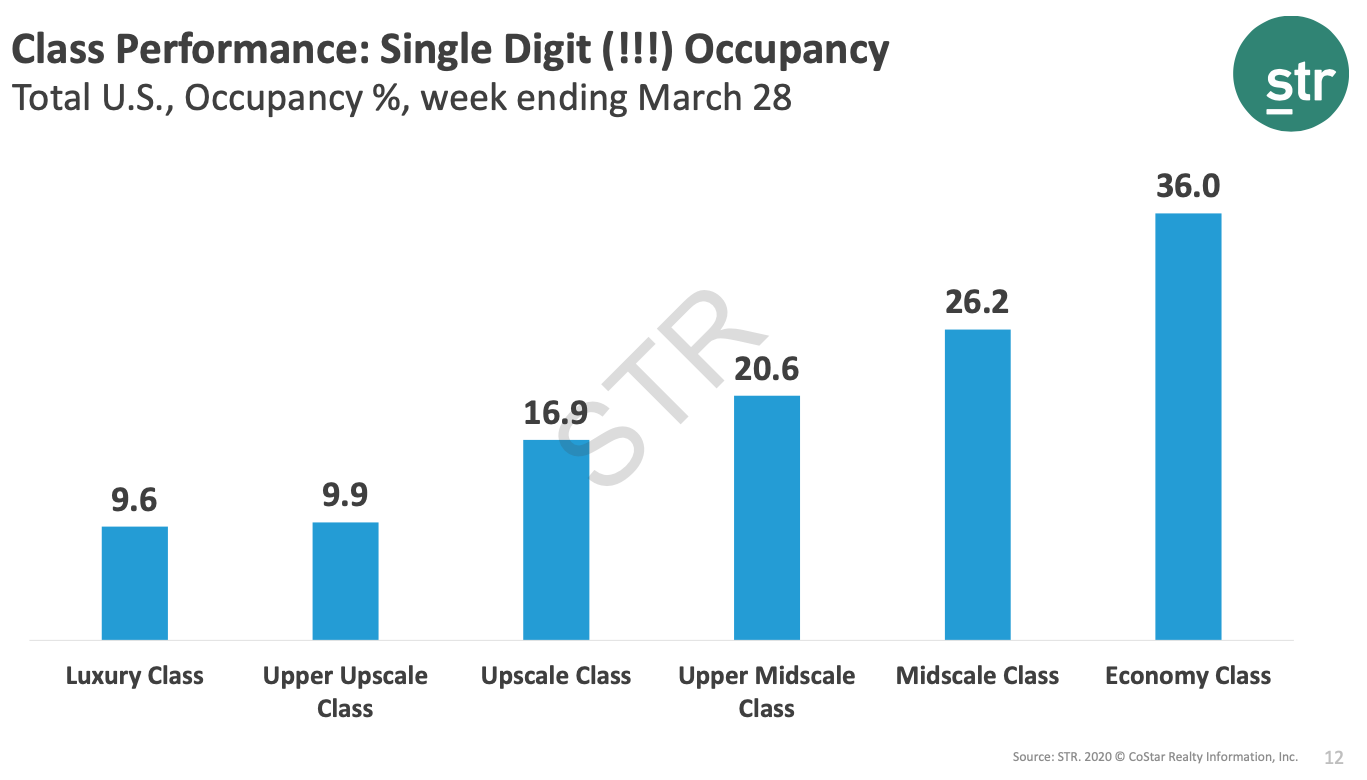

STR’s data shows that the percent of change in both RevPAR and overall occupancy differs across class types. Below are two graphs that illustrate the current trend:

Source: STR 2020 © Costar Realty Information, Inc.

Source: STR 2020 © Costar Realty Information, Inc.

The luxury and upper scale classes have taken the hardest hit, but what’s important to note here is the drop in the economy class is much less extreme, meaning many folks in this class are still traveling. There is still some demand for rooms, and now is not the time to sit idly by. Your reputation and visibility are critical to these economy class travelers who need quick stopovers or extended stays, and maintaining a presence on social media and active review response are just two ways you can do so.

There will continue to be travelers who need a place to stay.

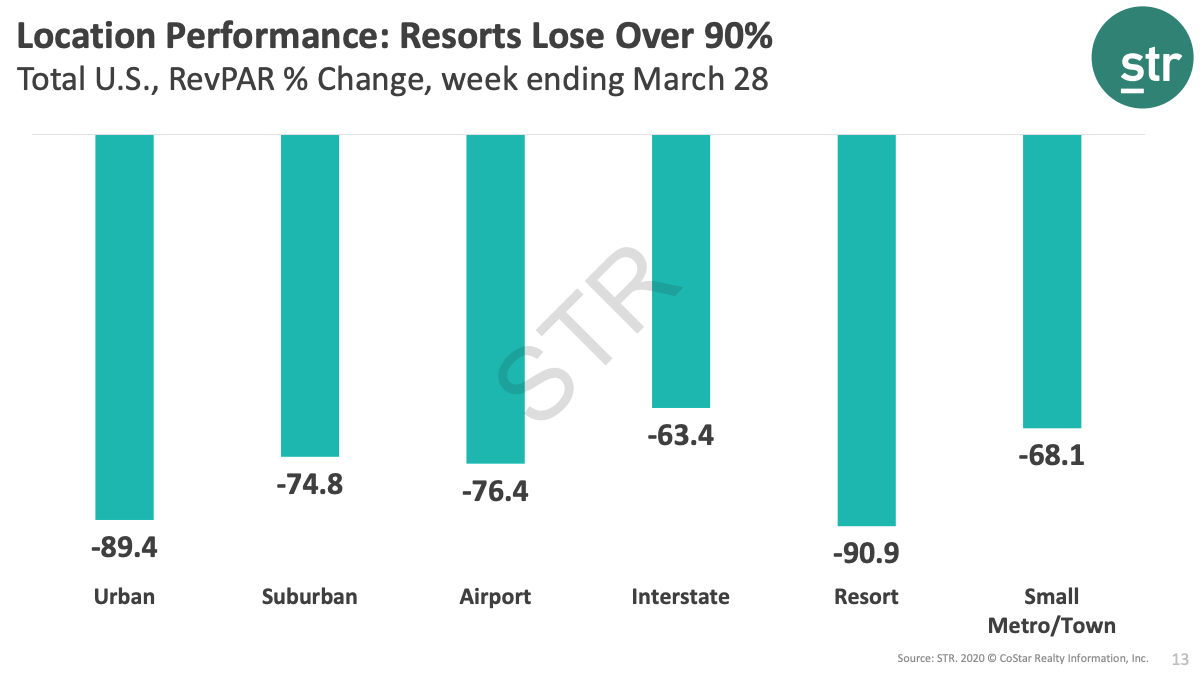

How are these travelers moving? What areas are we seeing with continued occupancy levels right now? The graph below showcases the breakdown by region type, which highlights where higher levels of occupancy are, such as small towns and interstate areas.

Source: STR 2020 © Costar Realty Information, Inc.

During the presentation, STR discussed that the impact across the US has started on the coasts, and seems to be slowly moving to affect suburban areas and smaller towns. However, areas that have retained better RevPAR and occupancy levels are those along the interstate and near airports. Essential workers who are transient, such as airline pilots and flight attendants, utilize hotels in these regions so they don’t have to risk infecting their loved ones as phantom flights are still ordered to take off nationwide.

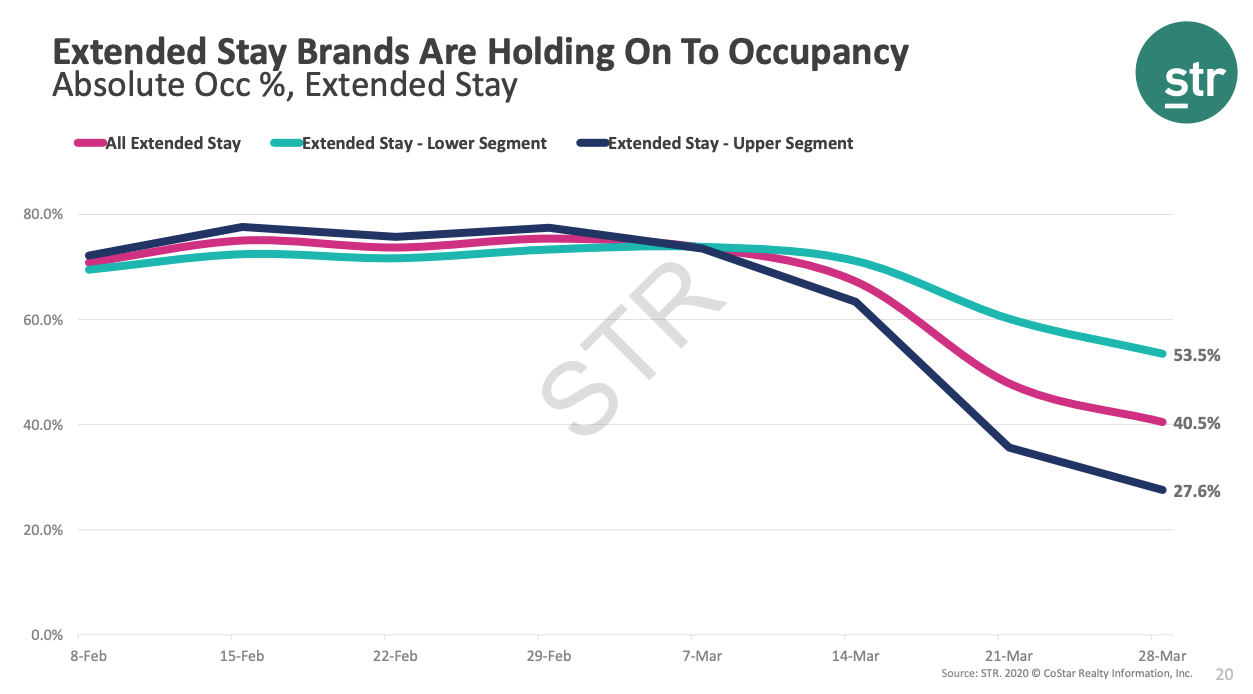

The graph below illustrates the retention of guest occupancy in extended stay properties, averaging about 40%, which is higher than other property types across the nation. This could be a result of many things, including travelers who are in the area to take care of loved ones or participate in medical research, but still need to maintain social distance or need a designated space to work.

Source: STR 2020 © Costar Realty Information, Inc.

Non-typical occupancy types may expand to other markets in the future. A compelling article from HotelNewsNow discusses how there are more available hotel beds in the U.S. than there are hospital beds, which may lead to an interesting opportunity for hoteliers to step up and help. The article suggests that, as usual clients leave, doors may be open to recovered coronavirus patients who are still required to be in quarantine. Although it’s a different audience than usual, now is the perfect time to make the connection with emergency services or hospitals in your area.

Usual travelers will come back, in time.

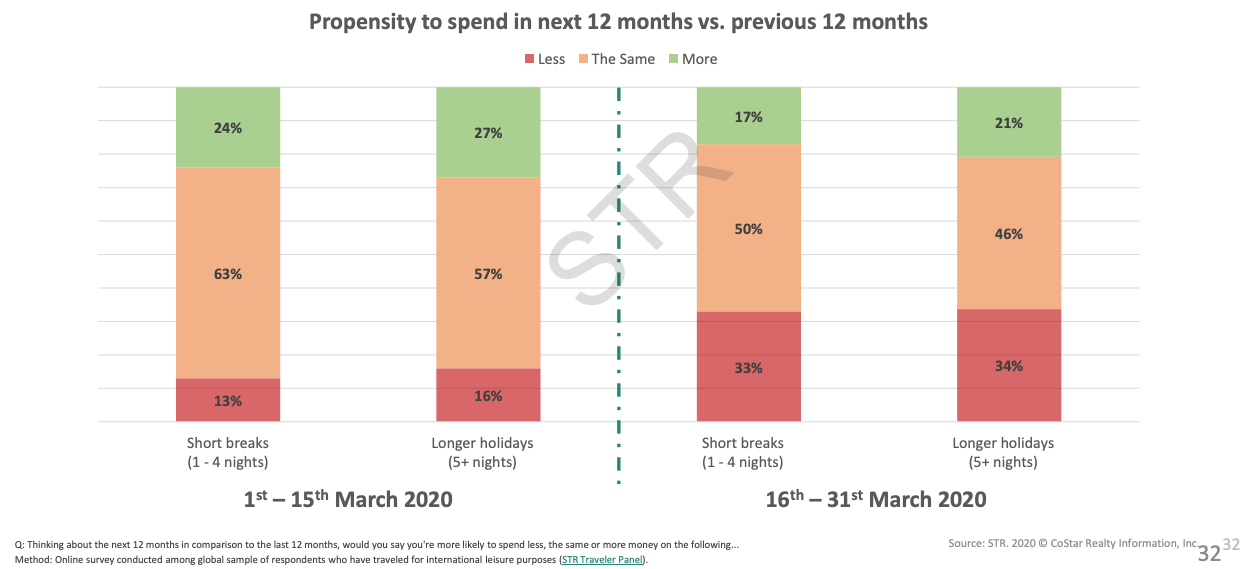

Times are stressful for everyone nationwide. In our first webinar, we recommended that hotels adopt flexible policies and communicate them clearly and empathetically with their guests. This ensures your guests remember you in a positive light, which will become critical once travel rates pick up again. It sounds far away right now, but STR polled their users and asked how likely they were to spend money on short breaks or longer holidays in the next 12 months.

Source: STR 2020 © Costar Realty Information, Inc.

Across both short breaks and longer holidays, over 50% of users who were polled last week answered that they would return to traveling just as much or more than usual in the next 12 months. While that return is not expected all at once, we can feel assured that once travel is deemed safe, those who were feeling wanderlust from being cooped up at home will be eager to return to their traveling lifestyle.

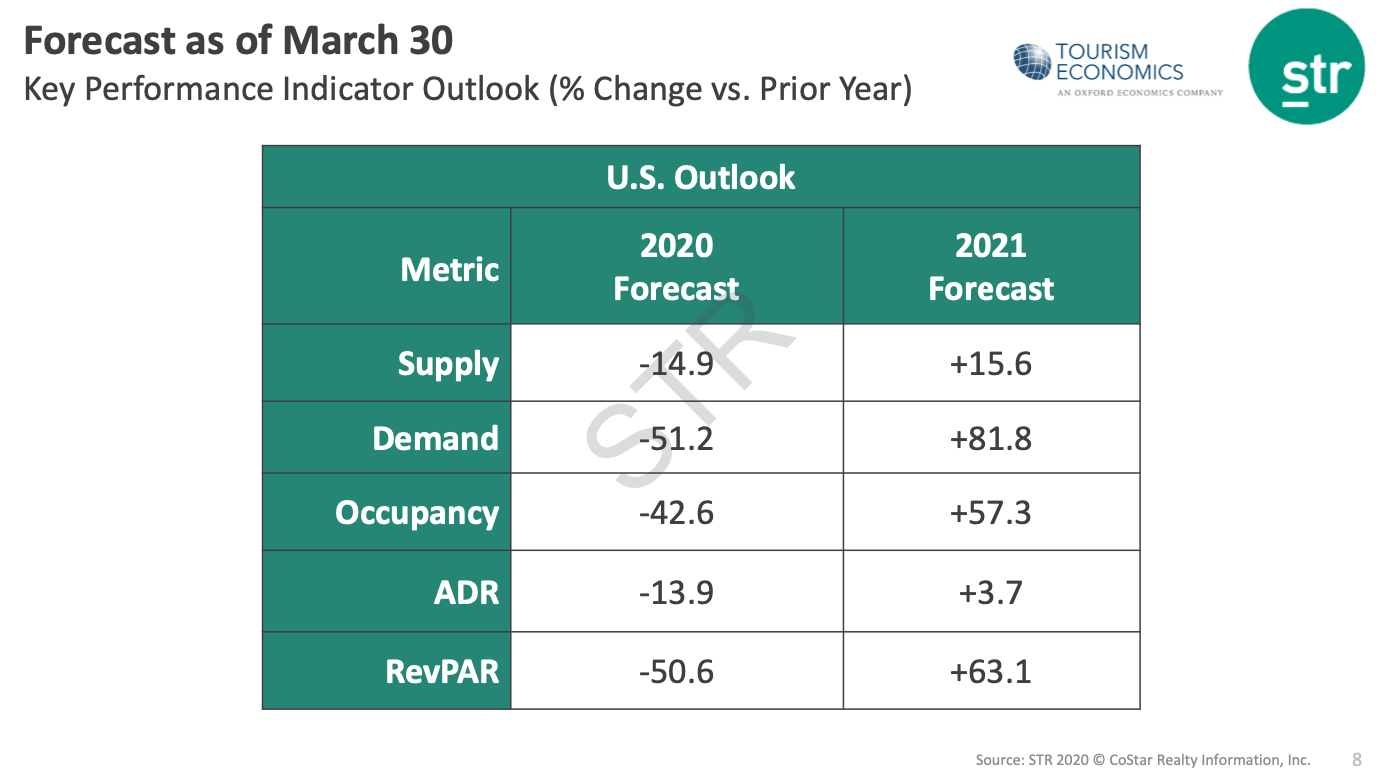

2021 is projected to be a rebound year.

After all is said and done, we know one thing for certain: our industry is resilient, and we will recover. In 2021, the projected demand is slated to recover to +81.8% compared to the current forecast of -51.2% this year. In the figure below, you can see that the forecast for 2021 does not completely project that the industry will rebound to where it was in 2019, but the numbers come close in many areas.

Source: STR 2020 © Costar Realty Information, Inc.

The world is facing an economic crisis on a scale we have not seen before, and it will take patience, teamwork, and optimism to continue to carry us forward during these troubling times. If you are a client of any of our services, don’t hesitate to reach out to your client success representative to find out more about how we can help you best prepare for the future. You can find all of our COVID-19 marketing resources for hotels at our dedicated online resource center.

0 Comments