Future-Focused Takeaways from STR’s Latest COVID-19 Impact on US Hotels

4 Key Takeaways

Thursday, April 16th, marked the last webinar of Smith Travel Research (STR) 5-week series showcasing the impact of the COVID-19 outbreak on the U.S. hotel industry. Below are some key takeaways from the presentation and where the industry stands today.

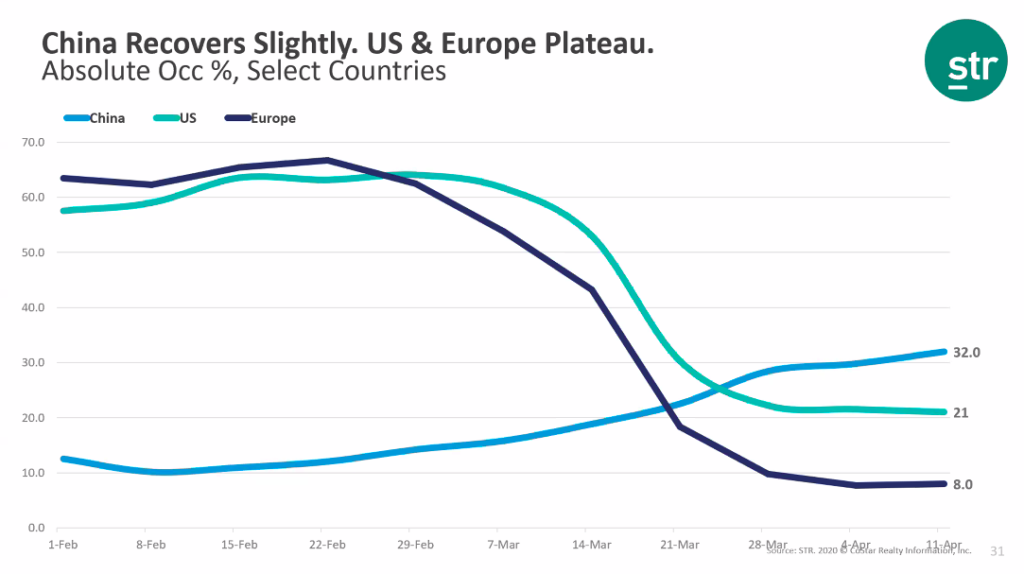

1. The US May Have Bottomed Out

Source: STR 2020 © Costar Realty Information, Inc.

Although hotel occupancy dove to historically low levels, we are starting to see signs that the industry might have plateaued. However, unlike China and Europe, whose occupancy rates bottomed out around single digits, STR’s data shows the US is signaling an occupancy low point of around 20%. If we continue to follow the same trend as China and start to see an uptick in occupancy in the next couple of months, we will be closer to recovery than other global markets. Although times are tough right now for US hoteliers, this should be good news for those looking for positive signs toward the road to recovery.

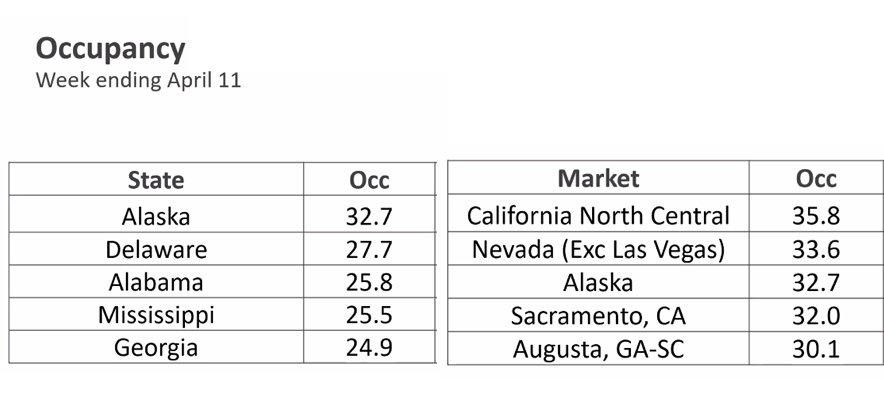

2. There Are Still Some “Bright” Spots

Source: STR 2020 © Costar Realty Information, Inc.

Although average US hotel occupancy is at an all-time low, STR has uncovered some markets and submarkets are performing significantly above that 20% occupancy mark. This demonstrates that there are still people traveling during this time. To capitalize on this demand, you should strategize creative ways of reaching those travelers to help fill rooms and improve occupancy. Leverage targeted social media campaigns and generate online reviews from hotel guests to help encourage travel and demand to your area. All the work you do today will set the foundation for recovery success down the road.

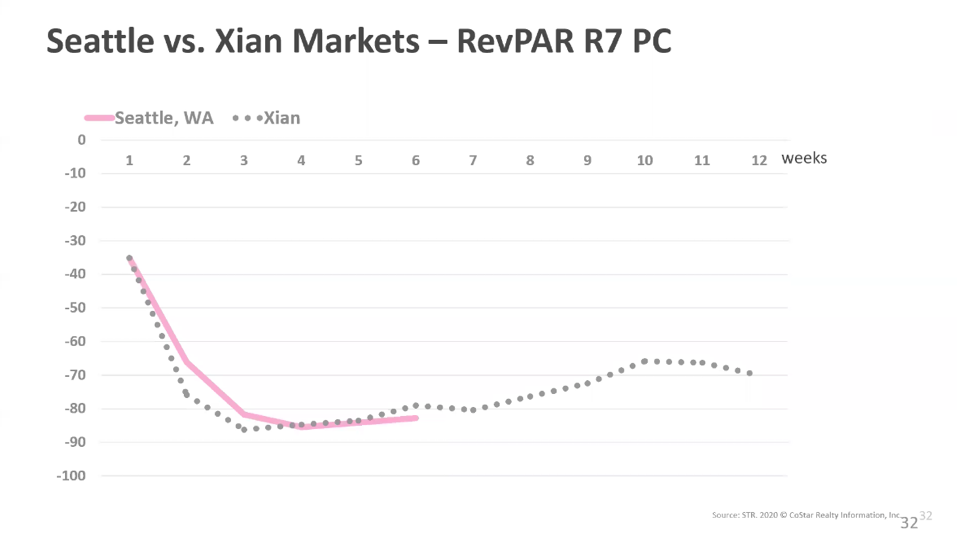

3. A Path Back to Recovery

Source: STR 2020 © Costar Realty Information, Inc.

Industry experts are always looking at data trends and patterns in an attempt to give us a glimpse of what we can expect in the future. STR has done an excellent job of finding a strong RevPAR correlation between two major markets in the US and China. Both Seattle and Xian show very similar timelines in RevPAR decline. STR also notes it was around this time that Xian began to start showing signs of RevPAR improvement and recovery. We will start to see more comparisons in data like this in other markets around our country as travel restrictions start to ease. We cannot predict when your market will rebound, but now is the time to start preparing and planning.

4. Get Ready For “Revenge Travel”

Source: STR 2020 © Costar Realty Information, Inc.

As we try to predict where the US hotel industry is headed over the next few months, we look for clues from the only global market starting to show signs of recovery, China. There we have seen the new term “Revenge Travel” start to emerge. Revenge Travel is a term used to describe all the pent up demand that has been building in the market since the announcement of “stay at home” orders. Travelers have been researching, planning, and now booking those trips that they have longed for during this cooped up period. This “revenge travel” is just the spark the industry needs to get back on its feet and moving toward our industry’s new normal. Start preparing and planning for this trend to follow suit in the US as restrictions start to loosen across the country. It’s important to make proper preparations now, to ensure your hotel is ready to welcome back these eager and excited travelers.

For more information, including industry data and the impacts of COVID-19, visit STR

0 Comments